Menu

By NCS Marketing

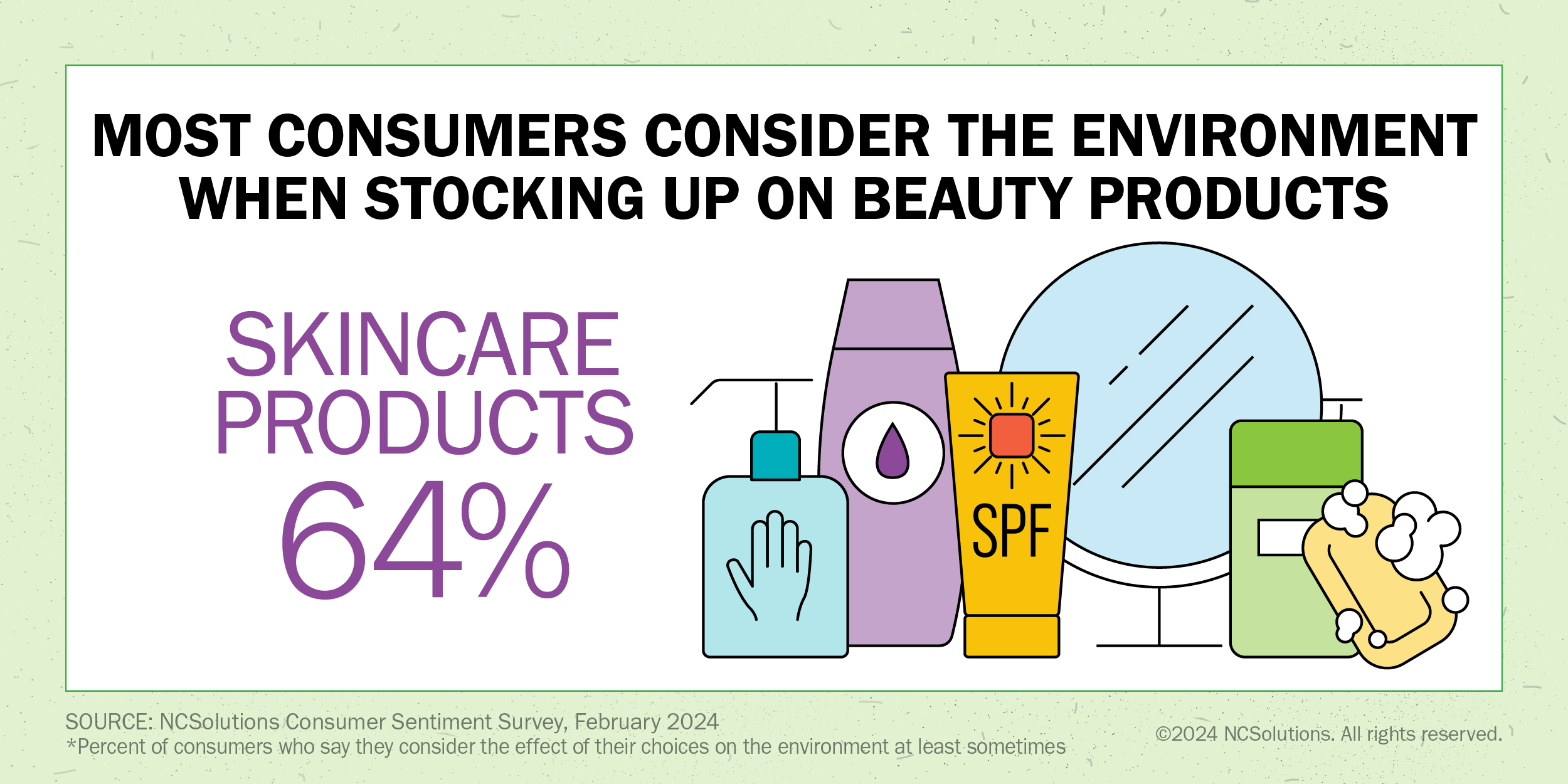

Beauty brands and retailers, listen up! Consumers today are heavily weighing the environmental and health impact of their purchase decisions, including the beauty products they buy. When shopping for skincare products, 64% of American consumers consider the impact of their product choice on the environment, at least sometimes.

To learn more about how consumers think about the sustainable beauty space, we commissioned a sentiment survey to ask Americans about their shopping habits and their opinions on wellness and sustainable products. We’ve paired these findings with a March 2024 analysis of NCS purchase data to examine how these consumer values translate at checkout and bring you the insights you need to engage your customers.

Consumers are increasingly aware of the short- and long-term impact of the chemicals in our personal care products. Couple that with growing concerns for the environment, and it makes sense that conscious consumerism is not just a trend but a persistent driver of buying decisions in the beauty sector and across other CPG categories. Sustainability is about to become a basic requirement for consumers to purchase, according to Harvard Business Review. Consumers are prioritizing products that are good for them and the Earth when it comes to their personal care and grooming.

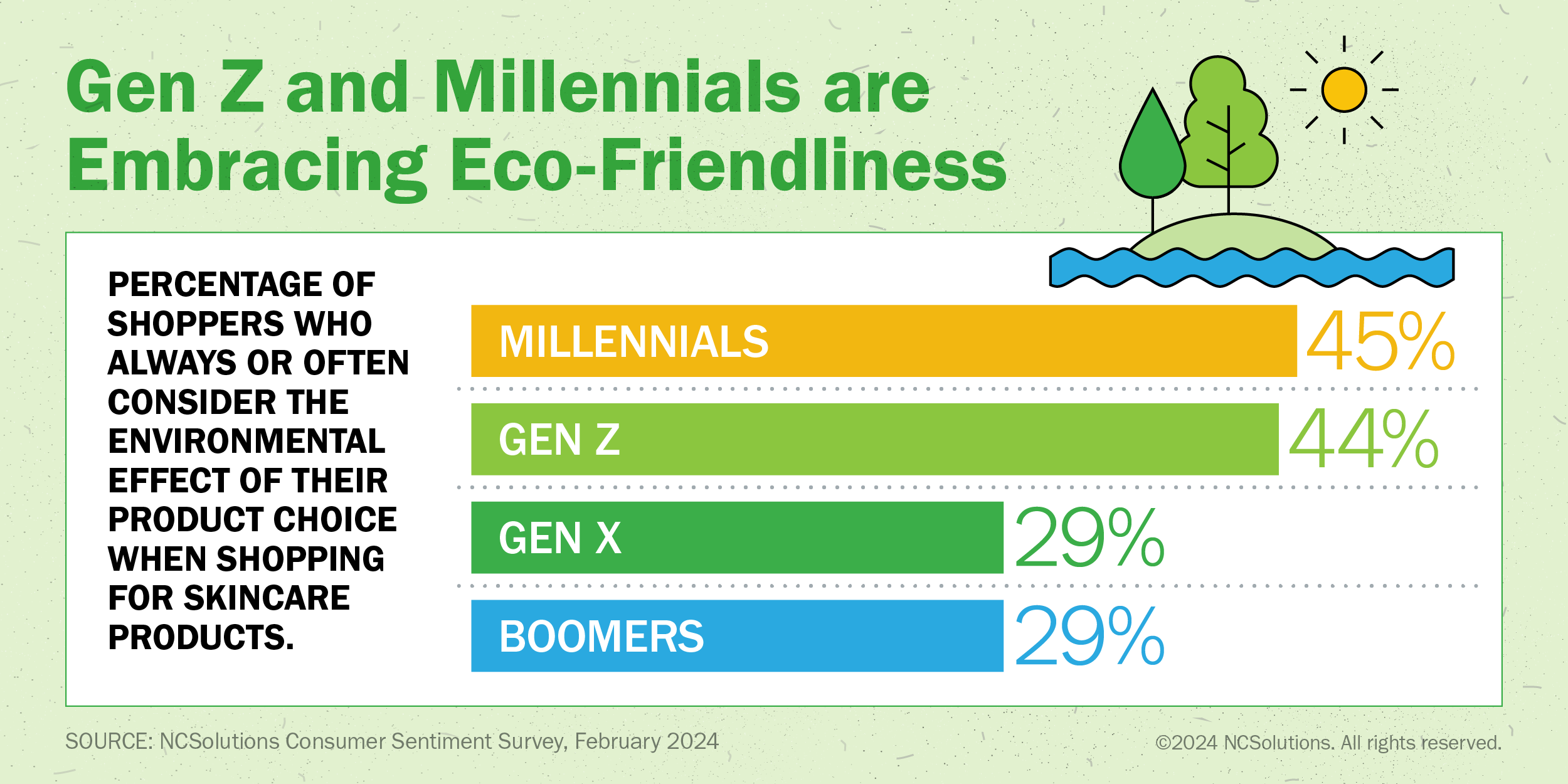

Younger consumers, who tend to buy more beauty products, are also the most likely to scrutinize the effect their products have on the planet and opt for eco-friendly skincare. Nearly half of millennials (45%) and zoomers (44%) always or often consider the environmental effect of their product choice on the planet when shopping for skincare. At the same time, about a third of Gen Xers and boomers say the same, according to our survey.

We’re sharing more about this sustainable beauty movement to help CPG marketers resonate with today’s thoughtful shoppers. Here are some ways consumers' interest in sustainability is factoring into their beauty-buying process.

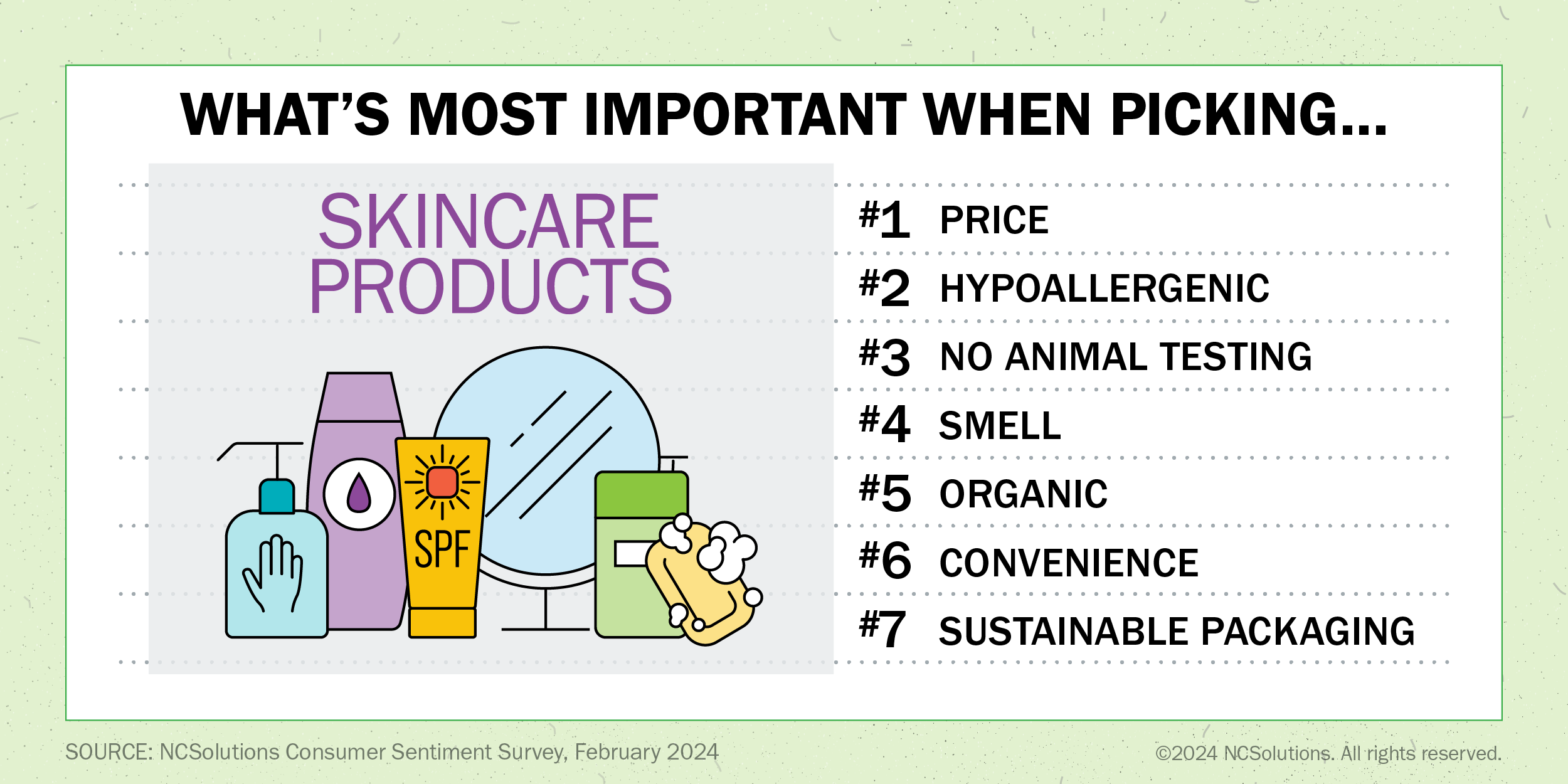

Consumers want products that are kind to their skin and kind to animals. While price is the top driver when buying skincare, the next aspects consumers consider are whether a product is hypoallergenic (gentle) and cruelty-free (no animal testing). They also value organic ingredients and sustainable packaging.

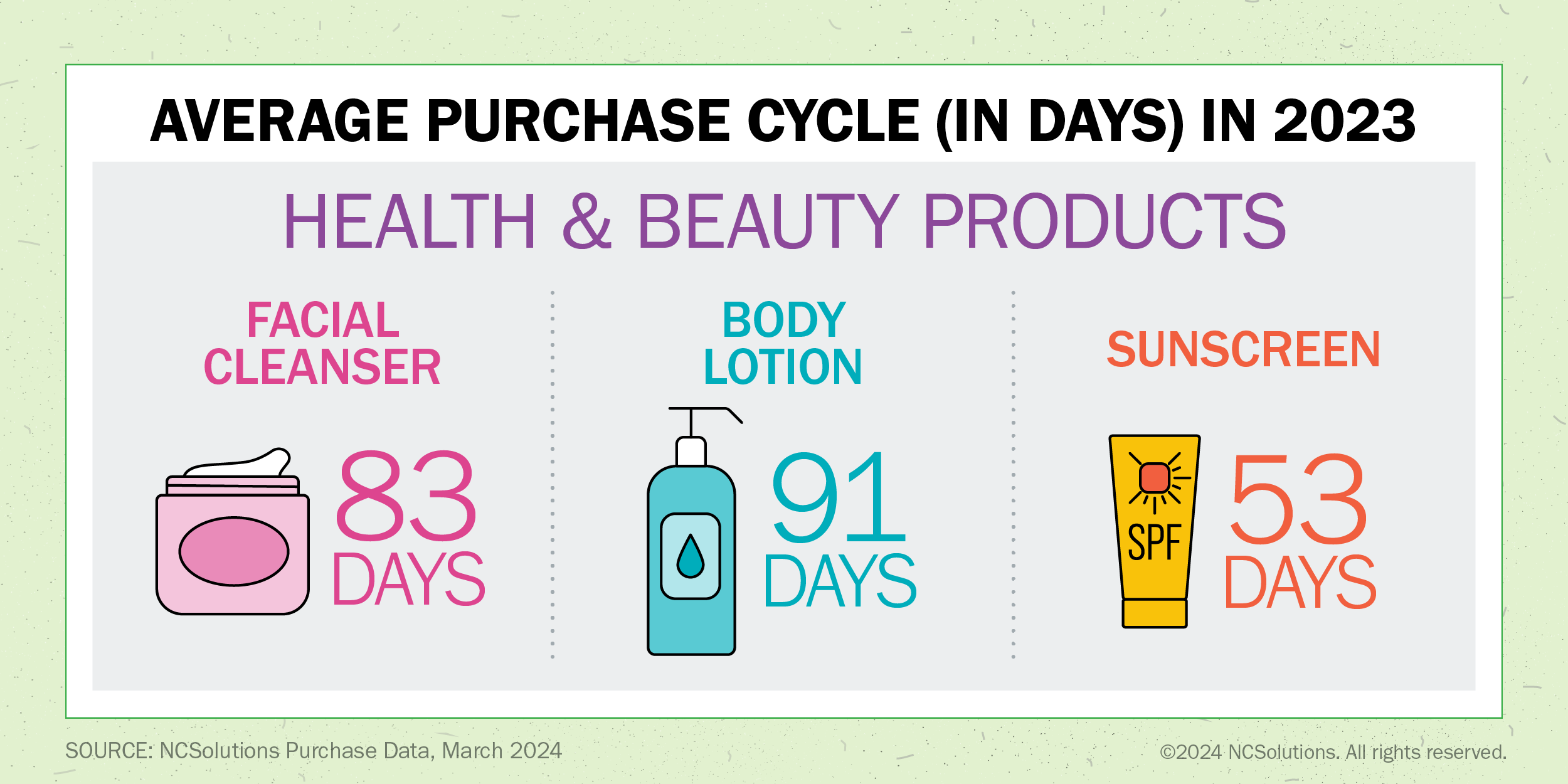

They buy facial cleansers, body lotion and sunscreen over a longer purchase cycle. In 2023, the average purchase cycle for facial cleanser was 83 days, body lotion 91 days, and sunscreen 53 days. To keep connected over this long purchase cycle, marketers are smart to stay in front of customers with advertising for their health and beauty items, so their brands are top of mind when it’s time for a restock. Digital advertising is an excellent way to do that: More than half (54%) of consumers discover health-enhancing skin-care products on the internet, while (40%) cited social media.

How often to serve these ads? A once-weekly frequency yields a higher return on ad spend (ROAS) and incremental dollars for every thousand impressions served. More often could be wasteful.

Buyers are loyal to brands that resonate with their values. With consumers prioritizing sustainability and wellness, it makes sense for beauty brands that align with those ideals to tout them in their messaging and positioning. When a CPG brand's mission resonates with consumer values, 58% are very or completely likely to buy that brand’s product. Also, 42% of consumers have a more positive perception of a brand when its marketing syncs with their values and preferences.

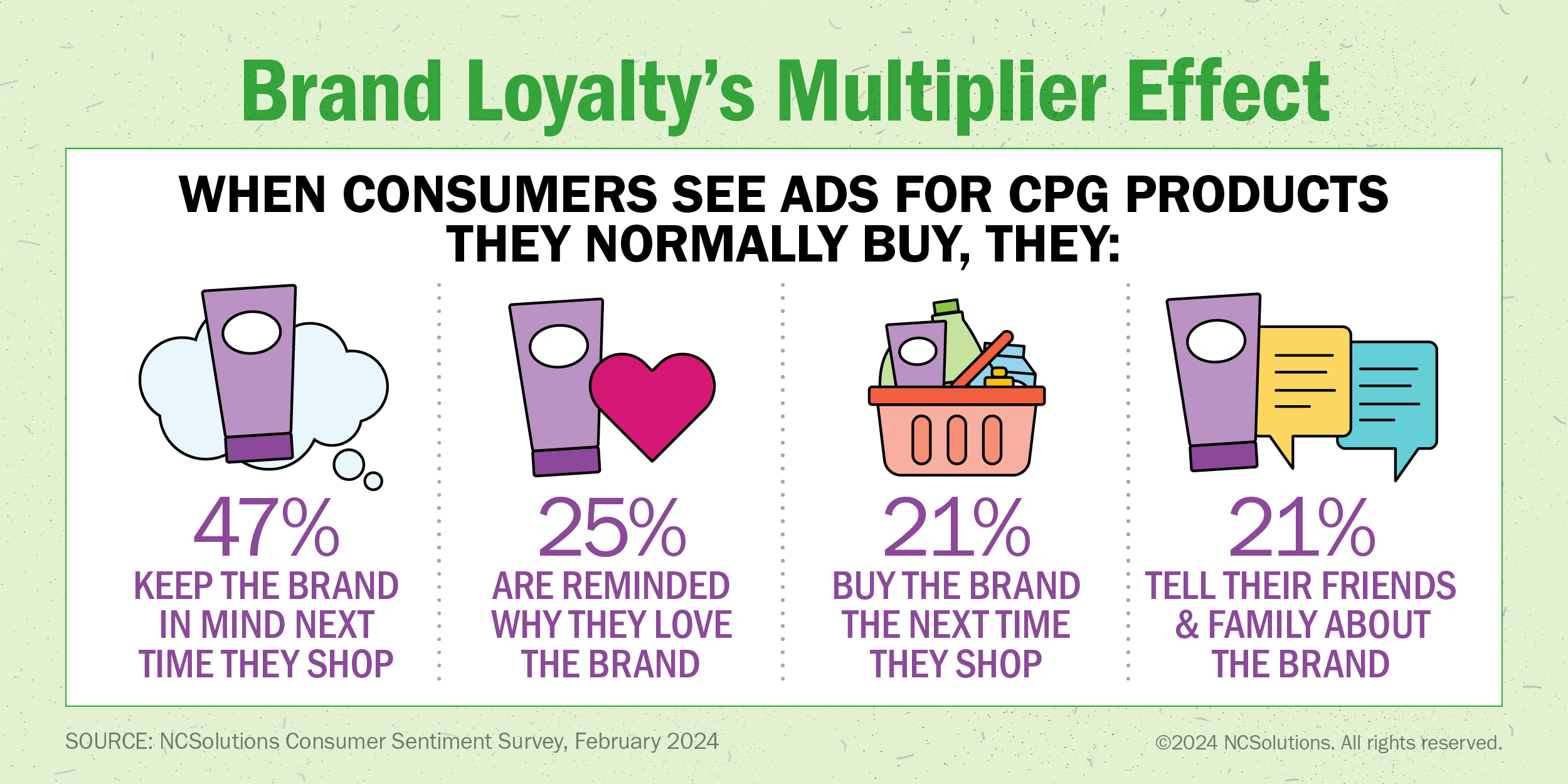

Advertising to your current skincare buyers can boost brand loyalty. Almost half (47%) of consumers say that when they see a brand advertising for CPG products they normally buy, they’re more likely to keep that brand in mind the next time they shop. Nearly a quarter (21%) buy the brand the next time they shop or tell their friends and family about it. Seeing an ad also reminds 25% of shoppers why they love the brand.

NCS can help you better connect with today’s conscious consumers who prioritize their health and the planet. To learn more about how American shoppers are factoring in health and sustainability across all CPG categories, access our e-book.

Subscribe for Updates

GET INSIDE THE MINDS OF CPG BRAND MARKETERS

Learn about their data-fueled strategies

SNAG YOUR COPY OF THE REPORT TODAY

WONDERING HOW CONSUMERS RESPOND TO INFLUENCER MARKETING?

See how creating content drives results

DOWNLOAD YOUR COPY NOW

WANT TO KNOW MORE ABOUT HEALTH AND ECO-MINDED SHOPPERS?

Get CPG insights to engage your buyers

ACCESS THE E-BOOK TODAY

.png)

.png)