By NCS Marketing

Gen Y and Gen Z Have Their Eyes on Beauty and Grooming Products

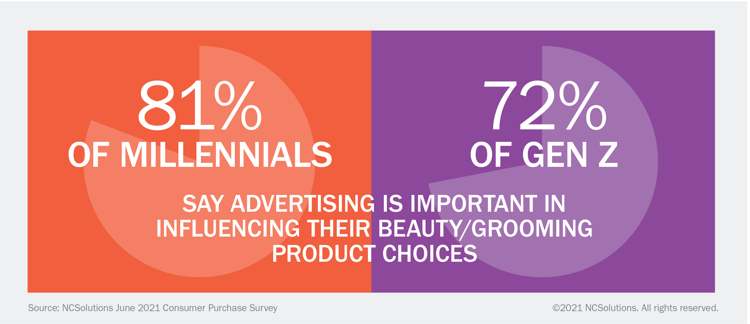

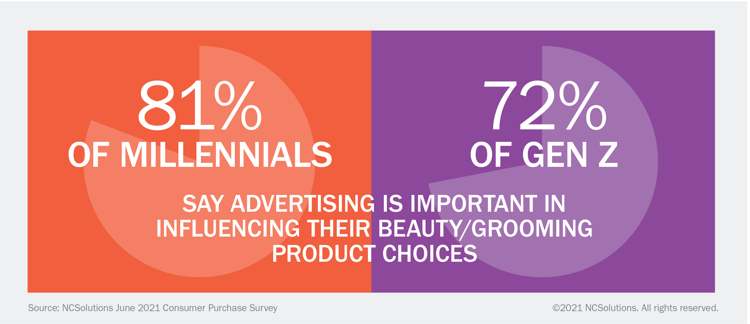

Beauty and grooming brands and retailers take note. Advertising creative plays a highly influential role in swaying Gen Y (aka Millennials) and Gen Z to buy your products, according our latest consumer survey.

These younger generations present a big opportunity for brands and retailers in the beauty and personal care space. More than half of Millennials (57%) and Gen Z (56%) anticipate they’ll spend more on beauty and grooming products in the coming months—compared to 39% for all generations.

So where are these younger generations going to discover beauty products that instill trust and make them look and feel their best?

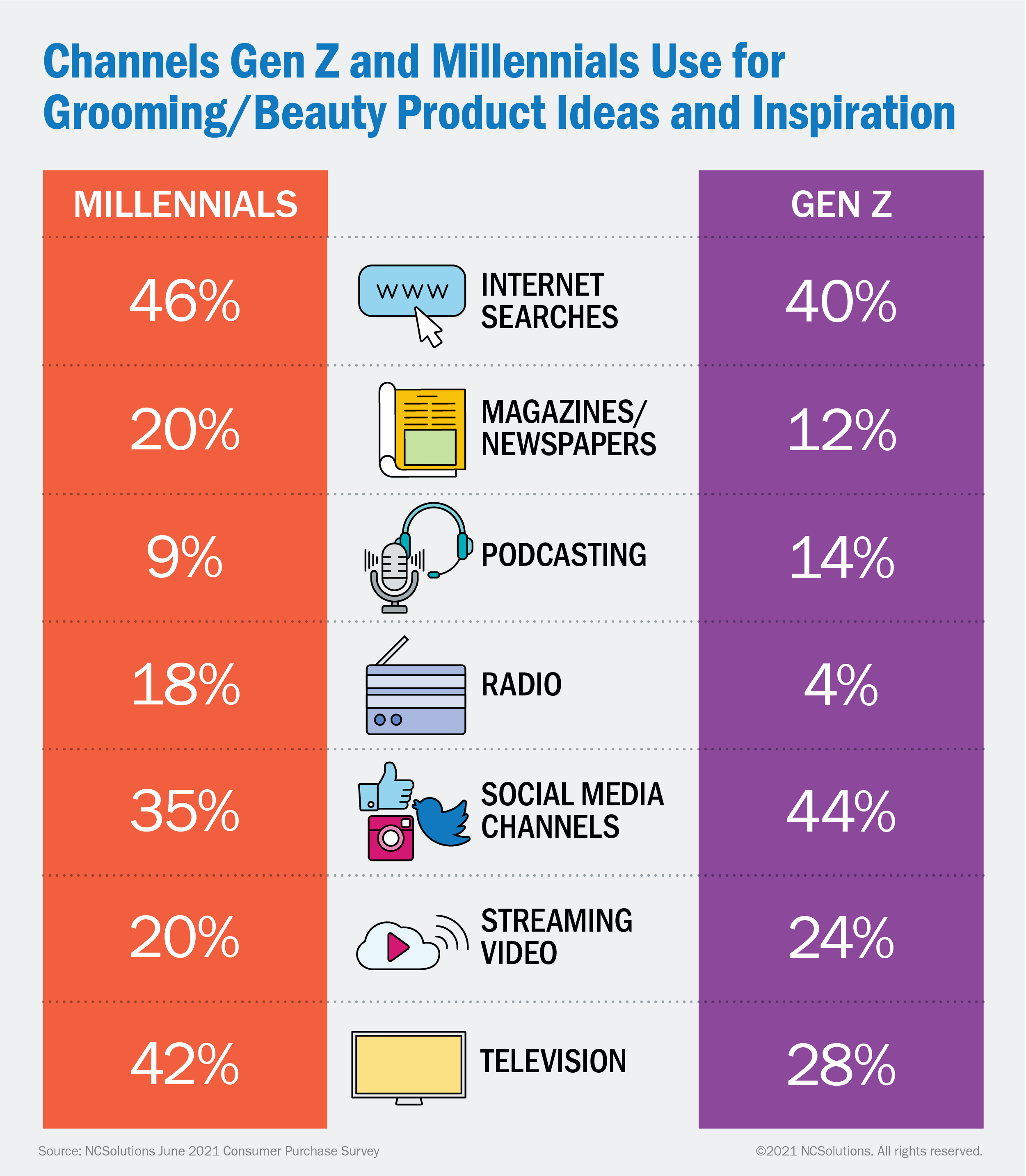

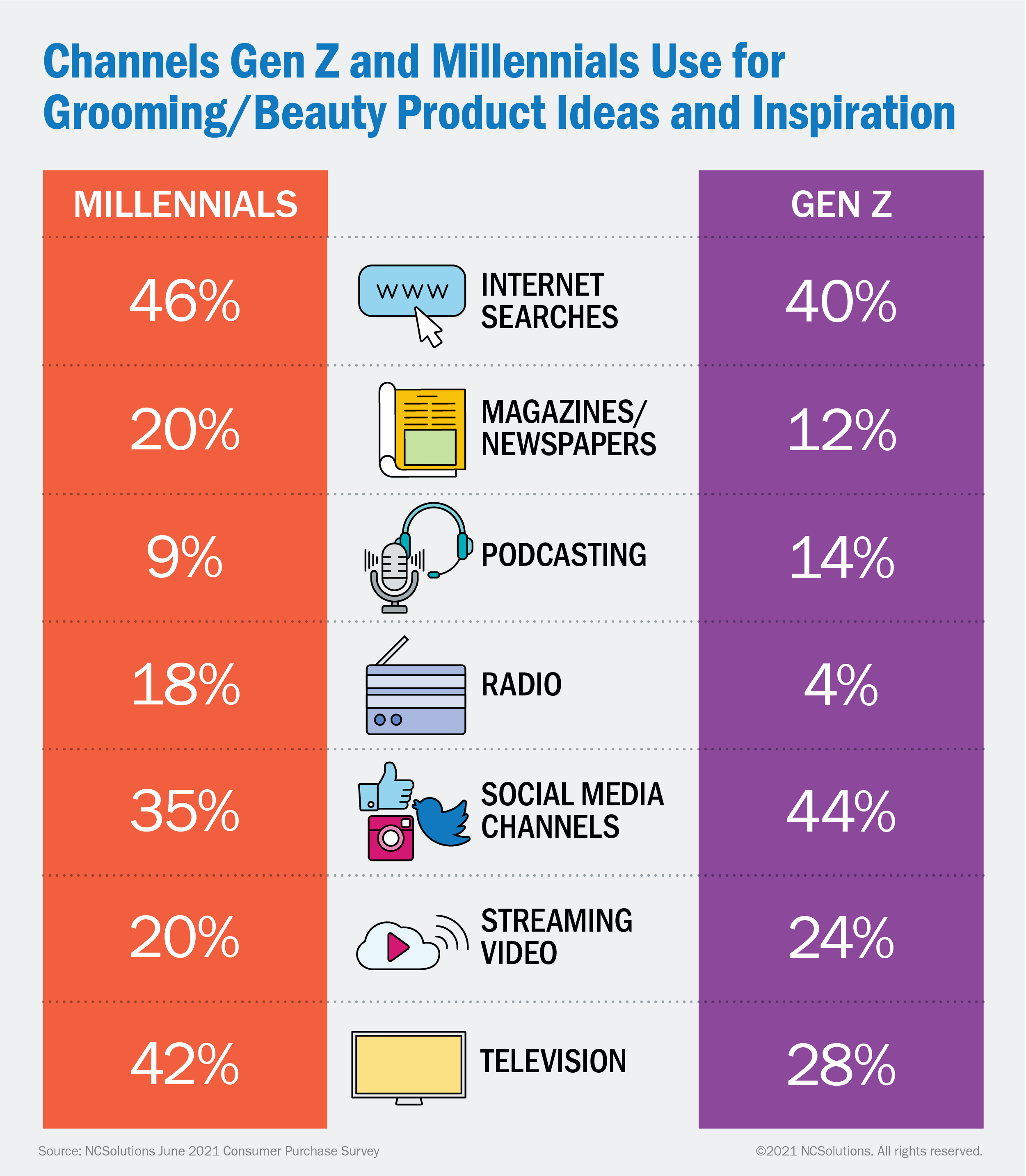

These younger shoppers take to their search browsers when looking for ideas for their next look, with television having a bigger influence on Millennials, and social media a greater influence for Gen Zs.

What else is motivating these younger generations’ use of beauty and grooming brands?

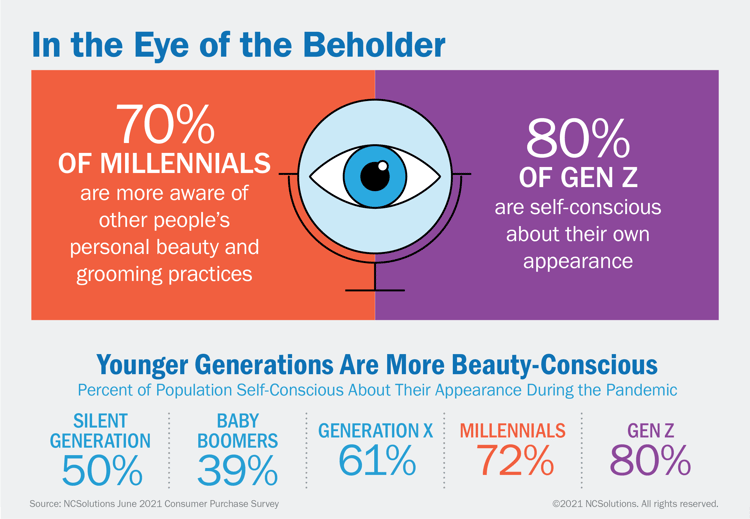

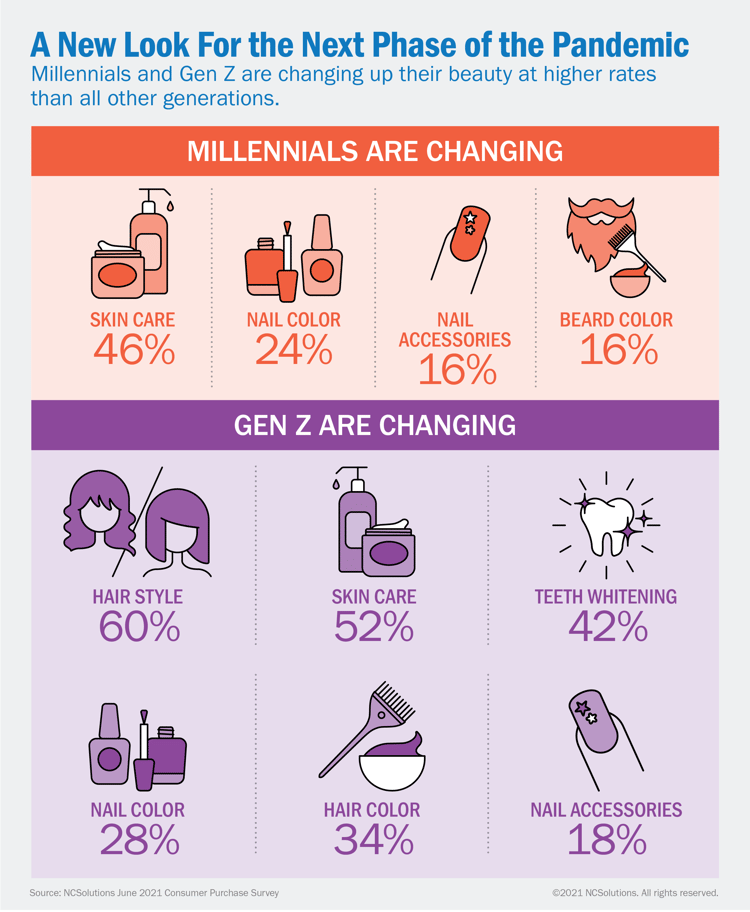

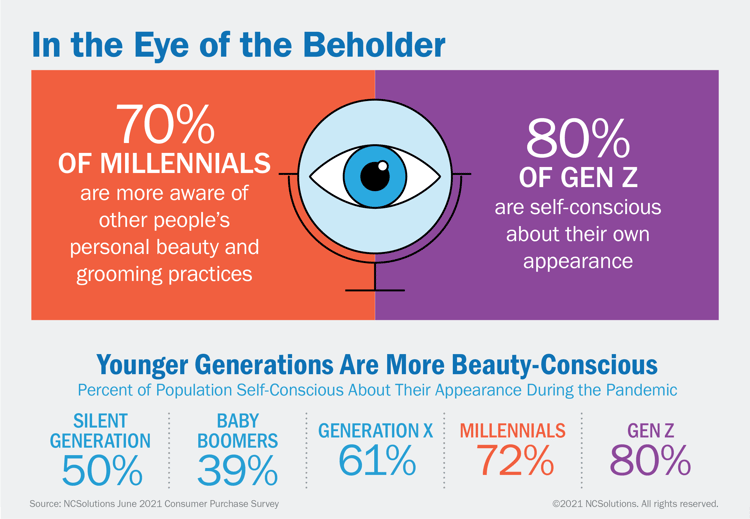

With heightened awareness for how they and those around them look, in the next phase of the pandemic, Gen Y and Zers are ready to look great—and they’re actively seeking ideas and inspiration from beauty brands and retail advertisers.

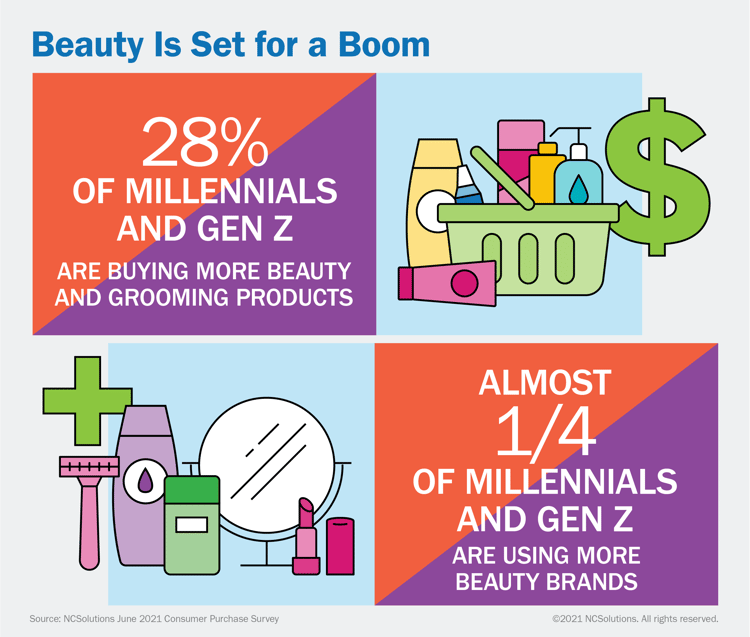

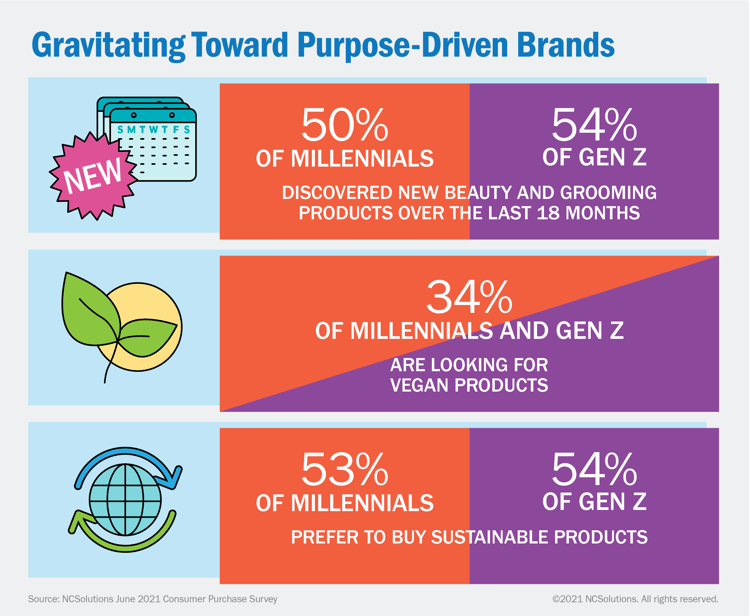

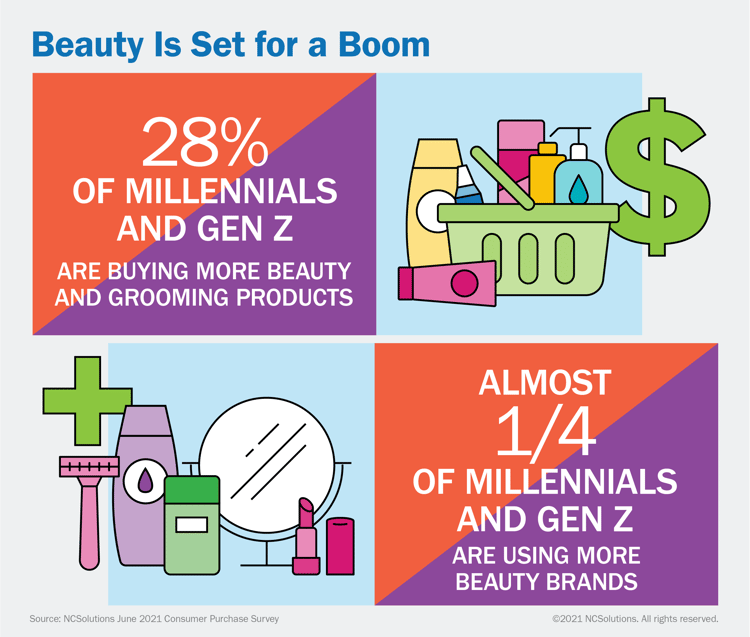

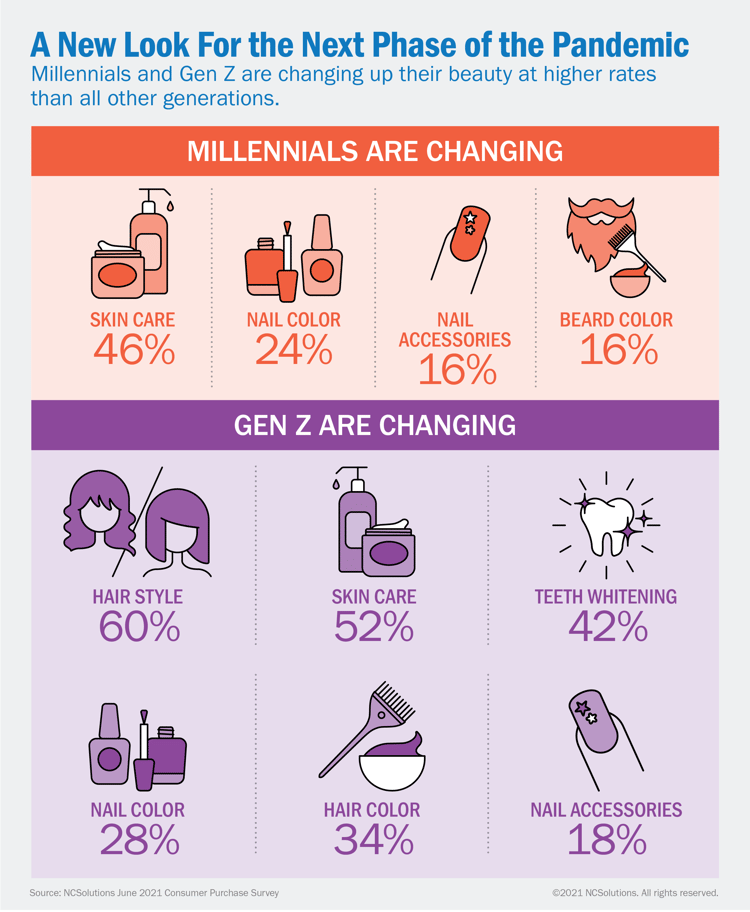

Beauty advertisers have an unprecedented opportunity to build brand loyalty among younger consumers. Not only have Millennials and Gen Z bought more products in the category, but they’ve been buying a wider variety of brands. During this time at home, they’ve been changing up their beauty routines and are open to trying new products.

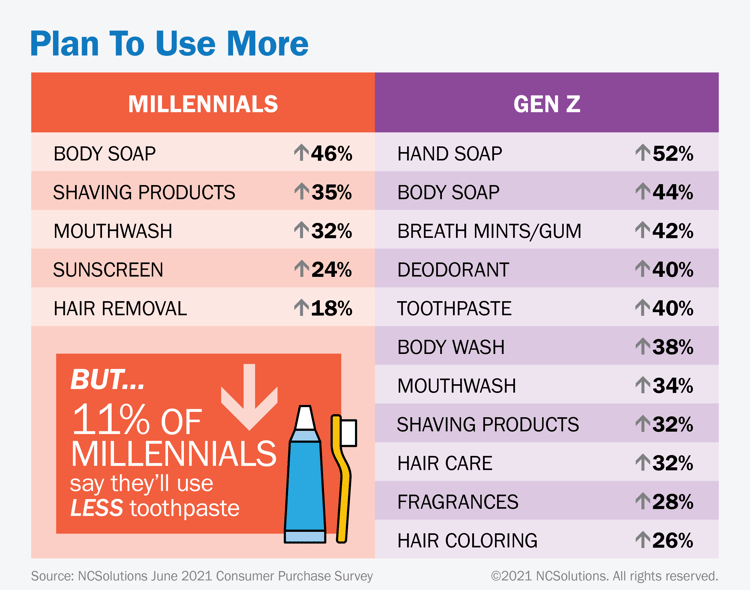

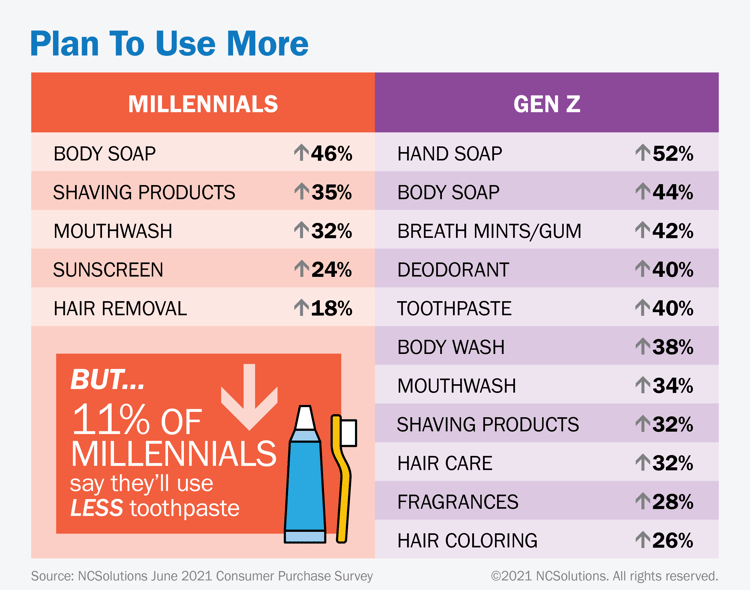

Whether it’s shaving that COVID beard or getting back into the rhythm of daily showers, younger generations are refreshing their looks and physical presence, with plans to increase their spending on a number of beauty and personal care products. (Except for that 11% of Millennials who plan to use less toothpaste, which we’re still trying to wrap our heads around.)

NCS research shows gains in market share are driven by trial buyers. With younger buyers showing renewed interest in beauty and grooming products, now’s an opportune time to launch an advertising campaign specifically for the people most likely to buy.

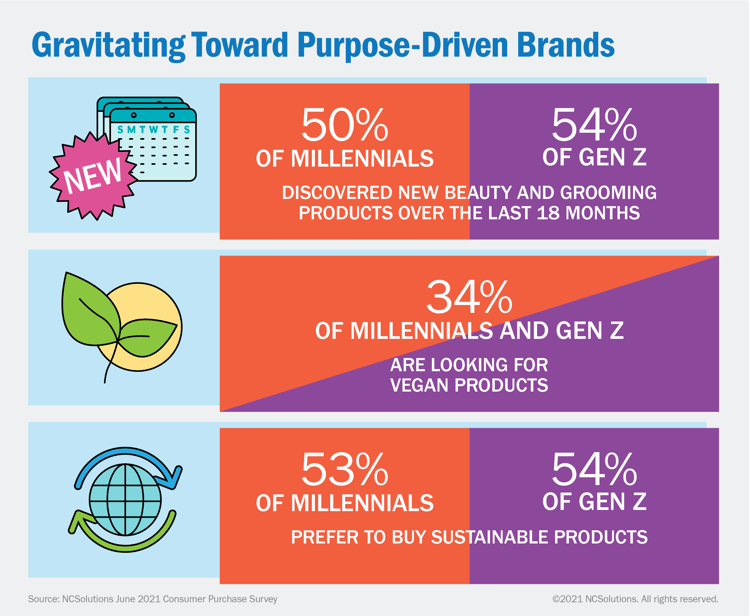

Purpose-driven attributes like sustainable and vegan products are driving Gen Y and Z to purchase—and brands that feature these ingredients can elevate this message in advertising targeted to younger consumers.

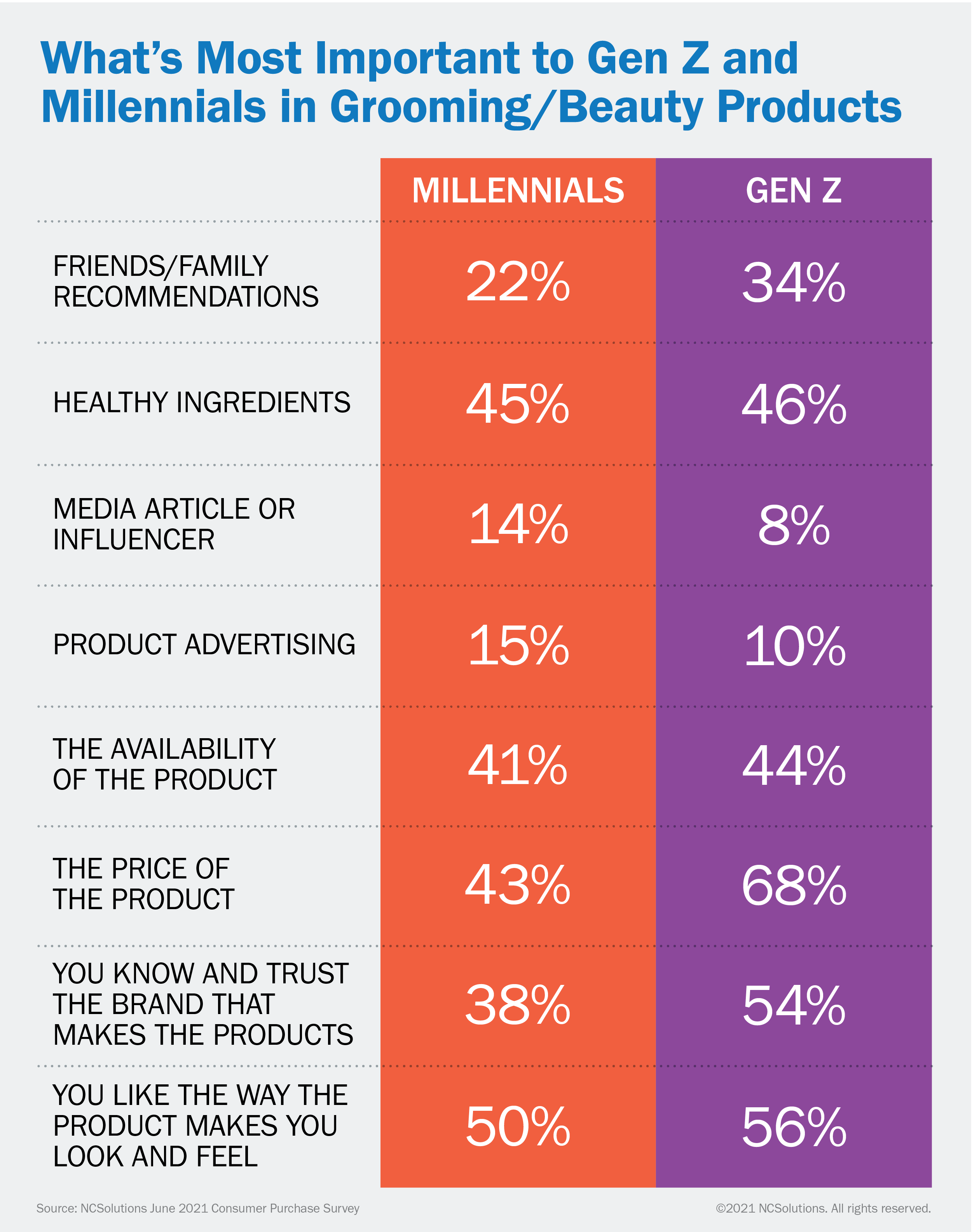

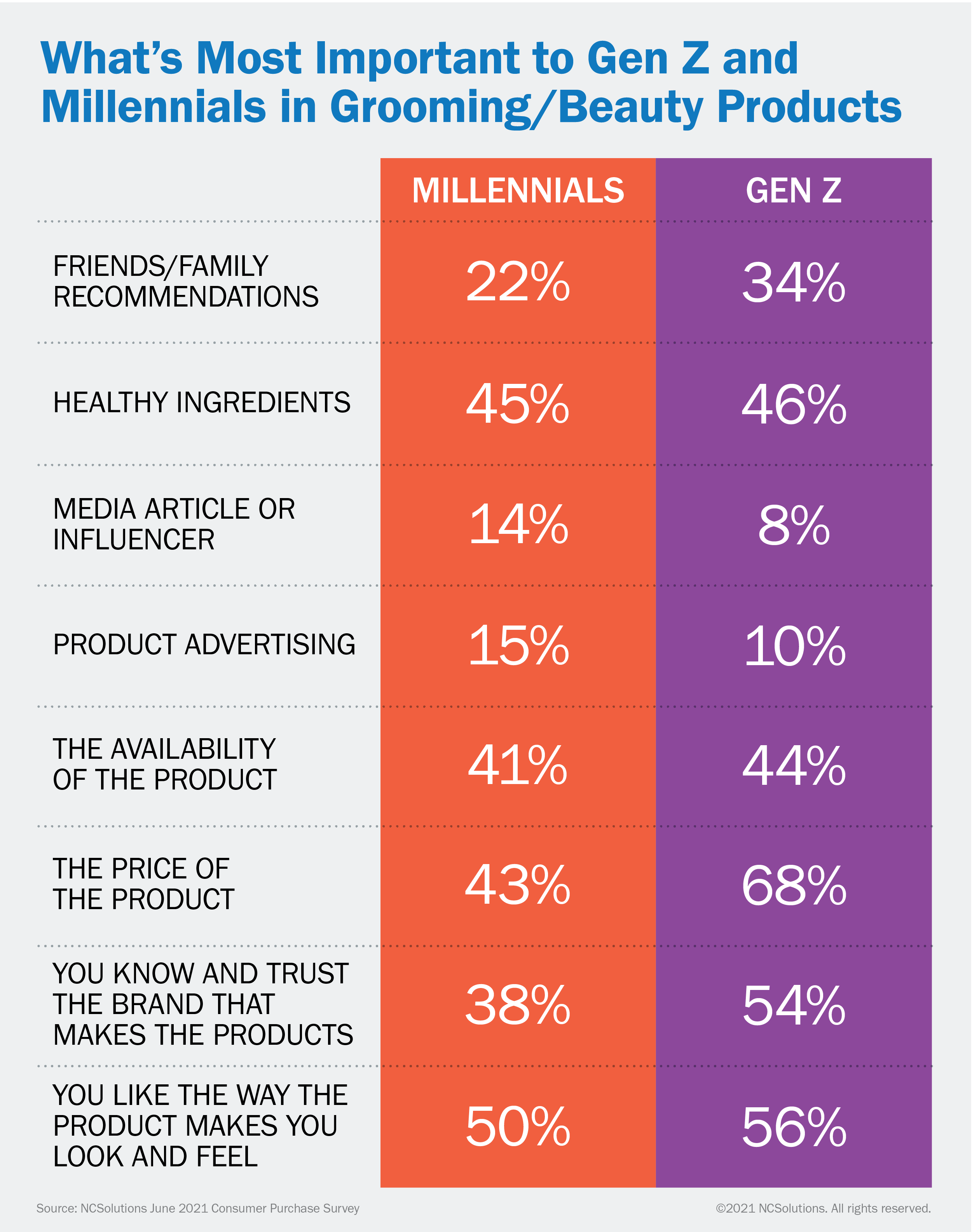

What else is influencing their beauty and grooming choices?

Both younger generations place a priority on how a product makes them look and feel, with Gen Z placing a higher priority on price and trust.

NCS can help you reach the younger consumers most likely to buy. For beauty buying trends across all generations, check out our full consumer sentiment survey results.

.png)

.png)